- Oil has become more of a problem for governments wanting to tackle climate change, and under pressure to block the opening up of new reserves.

- The Cambo field has become symbolic of the pressures on UK and Scottish governments. And for the independence movement, oil is more than symbolic.

- Under pressure from investors, campaigners and climate science, the industry is working hard to keep governments support for continued production.

Oil used to be what every government either treasured or craved: a gusher of windfall tax revenue, jobs galore, geo-political clout, and no need to depend on imports.

But economists talk of the "resource curse", in which too much of a good thing skews the economy, pushes up costs and crowds out other activity.

And now, there's a new sort of curse from having oil. For a country committed to reducing carbon emissions, it's at least as much a dilemma as a bonanza.

That's particularly true of a country taking a lead on tackling climate change, which is where the UK is currently situated, in the chair of the COP26 summit where deal-making will require leadership by example.

'Awkward factor'

As that summit is in Glasgow this November: as the oil and gas is mostly under Scottish waters: as the Scottish government wishes to be greener than Westminster while negotiating a power-sharing deal with the Scottish Greens: the dilemma applies also to the Scottish government.

The added awkward factor is that this black gold has fuelled the Scottish independence movement since the 1970s. The tax revenue bonanza will never come back, and the 2014 oil-lubricated case for independence is no more. But turning against Brent crude goes against all the instincts of an SNP leader.

So the question is; even without the power and responsibility to sanction extraction - a power which the SNP would like to have - do the Scottish and UK governments take a stand against new oilfield developments, or does it encourage the industry to extract what it can?

That question has become focussed on the Cambo oil field, west of Shetland. It's big, at 800 million barrels of oil or its gas equivalent (BOE). Production plans are for 60,000 barrels a day, loaded on to a floating production vessel.

To get an idea of how important that would be, last year saw the flow of oil and gas equivalent from UK waters at around 1.6m barrels per day. So it's not a game-changer. But it has become a symbol of the dilemma.

Climate checkpoint

Until March, the preferred policy was to "maximise economic recovery" and squeeze as much as possible out of ageing oil fields. That entailed the Oil and Gas Authority (OGA) requiring oil companies to co-operate on facilities such as pipelines, keeping them open to avoid elderly oil and gas fields being stranded.

Meanwhile, new rounds of licences continued to be distributed to oil companies, giving them permission to explore for new reserves.

That policy changed in March. Gone was "financial support for the fossil fuel energy sector..." So all those tax breaks for drilling, which gathered pace over the past ten years? Gone? Er, no. The next word was "overseas".

There was also a requirement that new licences have to pass "a new climate compatibility checkpoint before each future oil and gas licensing round to ensure licences awarded are aligned with wider climate objectives, including net-zero emissions by 2050". (Good luck to the OGA in making sense of that.)

The North Sea Transition Deal was a pact with the industry to say it could keep drilling and producing, but it would have to invest a lot in reducing its own considerable emissions in the production process, down by half within nine years.

It also committed to pour billions into the shift to hydrogen production, and to carbon capture and storage. The industry likes that, even if neither is yet commercially viable. It's allowed to keep drilling for oil and gas, and in turn, government has to remove obstacles to those mitigating new industries.

Hard-fought territory

In short. We're in a transition, and the decline of the UK's offshore oil and gas sector is now in political play. Its decline was inevitable, with production potentially lasting five or six more decades. But the question now is how fast it should be allowed or required to happen.

The industry points out there are jobs at stake. The number in the UK's oil and gas sector has fallen, but it's still plenty - around 150,000 directly or indirectly employed, and these are high-value jobs.

In Scotland, the estimate is of 108,000 jobs, also including those supported by induced spending (when oil workers spend their salaries).

Many are in the hard-fought political territory of north-east Scotland. And that is why Nicola Sturgeon is in a particularly difficult position.

Labour says she must firmly and loudly say "no" to Cambo. Scottish Greens expect no less, and it will be interesting to see if they extract a shift in tone from their deal on sharing government power.

Under pressure to take sides, the first minister has issued a very cautious call for licensing to be "reassessed" and for the "just transition" to be "appropriately rapid". But her letter to Boris Johnson also carries a heavy emphasis on the importance of jobs to the UK and Scottish economy. It's a difficult line to tread. Or an uncomfortable fence to sit on.

Investor pressure

The startling report from the Intergovernmental Panel on Climate Change this week pushes politicians and public towards more acceptance that oil and gas developments will have to be, at least, reined in.

The industry counters that not all of its output is burned. It's important for chemicals and plastics. Its advocates add that the transition to renewable energy has a long way to run. And until it is finished, there will be a need for oil to power trucks, trains and planes, and for gas to heat homes and businesses.

The consequence of stopping new developments, and putting a chill on further investment in existing fields, could be rising prices, bringing the opposite political pressure from consumers.

And if not oil and gas from British waters, which provide roughly half of the country's energy needs, that would mean higher dependence on imported energy, at a cost in dollars, the emissions from oil tankers, and diplomatic clout. Do we really want to give up a British industry, to rely instead on the Persian Gulf and Russia?

Yet the energy industry itself is on the move. Oil companies like BP, Shell, Equinor, Total and ENI - though less so the US majors - are pouring investment into renewable energy, in response to consumer and investor pressure. They don't want to be left stranded, like some of those offshore reserves, if political support is also withdrawn.

Just transition

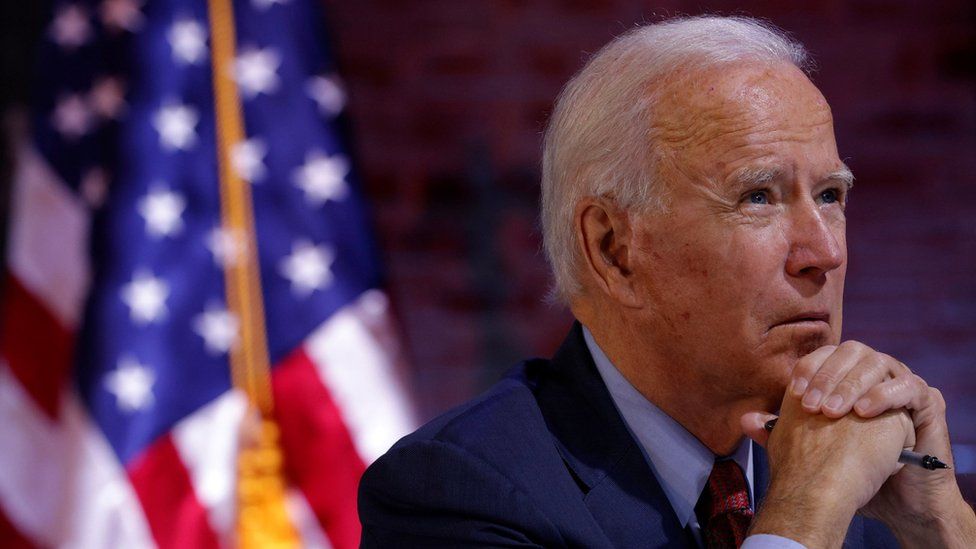

Similar dilemmas afflict other political leaders. President Joe Biden has taken a much firmer line than his predecessor on the risks of climate change; re-committing to the Paris accord, revoking permission for a key pipeline, and pulling back on drilling licences on federal land and the Arctic.

But with oil prices relatively high, and causing pain on the American forecourt, domestic political pressure now sees him calling on the Opec oil exporting cartel to turn the taps on, and get the price down.

Others have decided to stop drilling for new reserves, though not many. Denmark did so last December. The new administration in Nuuk, the capital of Greenland, has ended years of speculation that its waters could be a huge new basin of hydrocarbon reserves. That saw Edinburgh's Cairn Energy as one of the pioneering drillers, now departed for warmer waters, including the North Sea.

Such countries have other options - Denmark with renewables, and Greenland with onshore minerals.

Scotland has abundant renewables as well. A report from Scottish Enterprise this week set out the case for Scotland to be a world leader in hydrogen production, but also set out the threat that others can rival it, at lower cost.

That "just transition", meaning economic justice for those affected, is perhaps the most important challenge facing the Scottish government as well as the UK one. The growing pressure to make it "appropriately rapid" doesn't make it any easier.

"oil" - Google News

August 13, 2021 at 03:41AM

https://ift.tt/3CKb1gr

Oil: from bonanza to dilemma - BBC News

"oil" - Google News

https://ift.tt/2PqPpxF

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Oil: from bonanza to dilemma - BBC News"

Post a Comment