Russia’s invasion of Ukraine in February 2022 set off a wave of repercussions in energy markets and economies the world over. The hope of the U.S. and its allies has been that international pressure and mounting sanctions would cause Russia to swiftly end the war — or at least make it very difficult to finance. But while the war rages on and Russia seems to be coping with the short-term impacts reasonably well, the long-term effects on its energy sector could be much more significant. In today’s RBN blog, we look at how Russia’s twin challenges — finding buyers for its crude oil and its refined products — are more different than they might seem and why Russia’s oil-and-refining sector is in the early stages of a sustained slowdown.

The U.S. was among the first to respond to the invasion with sanctions, announcing just days after the war began that it would prohibit imports of Russian oil and certain refined products (along with LNG and coal) and ban U.S. investment in Russia’s energy sector. Similar measures were soon adopted by Australia, Canada, Japan and the UK, and Russian banks were banned from the SWIFT system, which enables financial transactions and plays a key role in the global oil trade. In addition, integrated oil companies such as BP, Equinor and Shell announced their intention to exit upstream oil and gas projects in Russia. The U.S. and the UK also rolled out foreign investment restrictions on several Russian companies and key figures in Russia’s energy industry were targeted for individual sanctions, including Igor Sechin (Rosneft), Nikolai Tokarev (Transneft) and Vagit Alekperov (Lukoil). We’ve written extensively about Europe’s move away from Russian natural gas and the resulting impact on global LNG trade, but sanctions have also targeted several other sectors (more on those in a bit).

In terms of a global reaction, the most expansive measures target Russia’s crude oil and refined product exports and are intended to diminish Russia’s ability to execute its war in Ukraine. The efforts targeting Russia’s crude exports may have gotten the majority of the headlines since last year, but it’s the sanctions on refined product exports and other measures that have Russia set up for significant long-term challenges. Let’s look at both of those efforts and see why their impact on Russia might be so different. (For more on the refined product market, check out The Future’s So Bright and the new Future of Fuels report from RBN’s Refined Fuels Analytics practice.)

On the oil side of things, the European Union’s (EU) partial embargo against Russian imports went into effect December 5. It prohibits the purchase, import or transfer of seaborne Russian crude unless purchased at or below a price cap established by the EU and the G-7 members — Canada, France, Germany, Italy, Japan, the UK, and the U.S. The price cap was set at $60/bbl, a target intended to be high enough to keep Russian barrels in the global market but low enough to hurt Russia financially. Pipeline imports of crude oil remain exempt, as some EU members depend on Russian imports via the Druzhba pipeline, but Russia has had to find a new home for barrels that traditionally headed for the EU and elsewhere. (Poland’s largest oil company, PKN Orlen SA, said February 25 that it had stopped receiving oil from Russia via the pipeline. As noted in this week’s RBN Crude Voyager, the stoppage is largely seen as retaliation for the country’s undaunting support of Ukraine.)

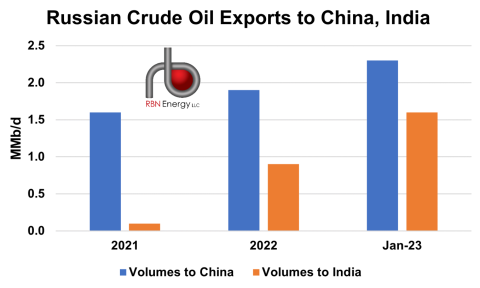

Figure 1. Russian Crude Oil Exports to China, India. Source: Oil & Gas Journal

There was a lot of hoopla about the import ban, implementation of the price cap and all the other sanctions and how much they might hamstring the Russian oil industry. There were also concerns that any or all of those measures might further disrupt the global market and lead to another price spike. The reality has been different for a few reasons, at least in the short term. For starters, it hasn’t been all that hard for Russia to find markets for its crude. By moving more barrels to refineries in China and India (see Figure 1 above), which are not part of any embargo, Russia has been able to find a new home for most (if not all) of its displaced crude, although possibly at deep discounts to global prices. Russian crude production and exports were up in 2022 and recently hit their highest levels since before the invasion. Russia has said it plans to cut production by 500 Mb/d (about 5% of its normal output) in March in response to the price cap. More recently, Russia has indicated it intends to cut exports from its western ports by as much as 25%, but that cuts elsewhere were not anticipated. The moves are seen by some as an attempt to boost the price of Russian oil and/or a signal that it can’t sell all the oil it’s currently producing.

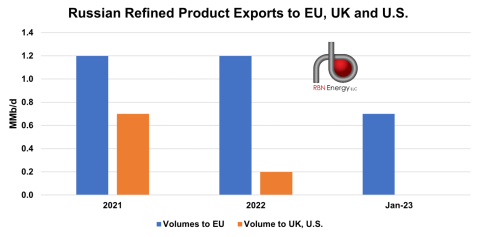

Refined products have been an all-together-different story (see Back in the USSR), one with major long-term complications. Russia has long been a significant exporter of finished refined products (mostly diesel) and intermediates (vacuum gasoil, naphtha, and resid/fuel oil). While Europe has been the primary destination for most of the finished products and an important consumer of intermediates, Russian VGO and resid had also grown to be an important source of feedstocks for U.S. refineries (see Figure 2 below). Just like with the embargo and price cap on Russian crude oil, the same tools are being used to target refined product exports. The EU’s embargo on those imports — which went into effect February 5 — is paired with a price cap, which is set at $100/bbl for products (like diesel) that trade at a premium to crude oil and $45/bbl for products (like naphtha and fuel oil) that typically trade below the price of crude.

Figure 2. Russian Refined Product Exports to the EU, UK and U.S. Source: Oil & Gas Journal

As we noted earlier, Russia has largely been able to move its crude to the global market, but the impact of the embargo and price cap on refined products has been more disruptive for a number of reasons. For starters, there’s the immediate challenge of finding a home for all those refined products. China and India might be willing to take on a lot more Russian crude, but they don’t need its products. (Rather, they would prefer to continue importing the crude at a steep discount and make their own products.) Without a couple of large buyers to pick up the slack, and with refined products needed virtually everywhere, Russia has had to work a lot harder in a lot more places to replace the markets that have been lost. The cost to move these relatively small volumes of products to so many highly dispersed locations is also much higher than the previous movements next door to Europe. In addition, many of the intermediate products can only go to a country with a developed refining sector, which means areas like Latin America and Africa often can’t take them.

Transportation is also an issue. Russian refineries are set up to move refined products by pipeline, generally to Europe, but the sanctions against it have largely turned off that outlet. Refined products can be moved to ports for seaborne transport, but Russia’s infrastructure is really not set up for that, and with more products now being moved on the water, that means freight demand will also increase, cutting the supply of ships and raising rates. A number of countries bumped up their purchases of Russian products ahead of the February 5 deadline, but those volumes have now fallen back.

Then there are the long-term impacts, which include sanctions on every key sector of the Russian economy — including agriculture, metals and mining, natural gas, petrochemicals and shipping — in addition to measures targeting its financial sector. That includes banking restrictions (like its removal from the SWIFT system, noted above) and new trade barriers. Like a rolling stone — as the song title to today’s blog implies — the momentum working against the Russian economy is only going to build in the months and years ahead. As we said earlier, Russia’s oil and products sector will face continued challenges from a lack of market access, especially for refined products, but that’s just part of the story. It also faces a future in which its access to Western technology is reduced, as Russia will find it difficult to replace some equipment internally, with the lack of specialized equipment and catalyst likely to hamstring operations.

On top of all that, brain drain is a real issue, with many of Russia’s best workers opting to flee the country, potentially creating a shortage of technical know-how. All told, that leaves a Russia that is less efficient, has a diminished capacity to invest in its own infrastructure and upgrade its refineries, and has less ability to produce and market finished product streams — with little chance of any of that changing for the better in the years ahead. This creates a growing market vacuum that U.S. refineries in particular, because of their natural gas and other cost advantages, may be well-positioned to fill.

“Like a Rolling Stone” was written by Bob Dylan and appears as the first song on side one of his sixth studio album, Highway 61 Revisited. Dylan wrote the confrontational lyrics as an extended verse after he returned to the U.S. after a grueling tour of the UK in June 1965. Honed down to four verses and a chorus, the song was recorded in two days at Columbia Studio A with Tom Wilson producing as part of the sessions for Dylan’s upcoming album. An interesting side note to the song is Al Kooper, who was known as a guitar player at the time, was hanging out at the studio as a guest of Tom Wilson. He convinced Wilson that he had a great organ part for the song, and they let him play the Hammond B3 organ for the song. If you listen carefully you can hear some of the organ parts come in a millisecond behind the beat because Kooper was following the fretting hands of Dylan and guitarist Mike Bloomfield to know what chords were being played. Hence, the signature organ part in the song was born. Columbia Records had hesitancy about the song because of its over six-minute length and its heavy electric sound, not realizing that it would change the course of popular music after its release. Released as a single in July 1965, it went to #2 on the Billboard Hot 100 Singles chart. Jimi Hendrix would later redefine “Like a Rolling Stone” at his debut performance at the Monterey Pop Festival in 1967. Personnel on the record were: Bob Dylan (lead vocal, electric guitar, harmonica), Mike Bloomfield (lead electric guitar), Al Kooper (Hammond B3 organ), Bruce Langhorne (tambourine), Frank Owens (tack piano), Joe Macho Jr. (bass), and Bobby Gregg (drums).

Highway 61 Revisited was recorded during June-August 1965 at Columbia Studio A in New York City with Bob Johnston producing and Tom Wilson producing “Like a Rolling Stone.” The album was released in August 1965 and went to #3 on the Billboard 200 Albums chart. It has been certified Platinum by the Recording Industry Association of America. The album was the first for Dylan to use rock musicians to back him. Four singles were released from the LP.

Bob Dylan is an American singer, songwriter, musician, actor, author, poet, painter, and illustrator. He has been a popular culture icon in a career that has spanned more than six decades. He is considered by many to be the greatest songwriter of all time. He has released 39 studio albums, 15 live albums, 29 compilation albums, 18 EPs, seven soundtrack albums and 95 singles, and has sold more than 125 million records worldwide. He has earned 10 Grammy Awards, one Golden Globe, one Academy Award, and has a Presidential Medal of Freedom, a Pulitzer Prize special citation, and a Nobel prize in Literature. He is a member of the Rock and Roll Hall of Fame, Songwriters Hall of Fame, and Nashville Songwriters Hall of Fame. Dylan’s archives are housed at the Bob Dylan Center which opened in Tulsa, OK, in May 2022. Dylan continues to record and tour and will be touring Japan in April 2023. His latest book of essays, The Philosophy of Modern Song, was published in September 2022.

"oil" - Google News

March 01, 2023 at 09:00AM

https://ift.tt/4ARksGm

Like a Rolling Stone - With Sanctions in Place, Russia's Oil-and-Refining Sector Faces a Slow, Steady Decline - RBN Energy

"oil" - Google News

https://ift.tt/hBQUmCP

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Like a Rolling Stone - With Sanctions in Place, Russia's Oil-and-Refining Sector Faces a Slow, Steady Decline - RBN Energy"

Post a Comment