(Bloomberg) -- Just three years ago, when OPEC+ oil giants fell out, the US found itself playing the role of peacemaker. Now it looks more like their target.

Most Read from Bloomberg

The Saudi-Russia oil alliance has the potential to cause all kinds of trouble for the US economy — and even for President Joe Biden’s re-election campaign. This month’s OPEC+ decision to cut crude output, for the second time since Biden flew to Saudi Arabia last summer seeking an increase, may be just the start.

That April 2 announcement has lifted oil prices by about $5 a barrel. OPEC’s own projections show that the cuts will widen the supply shortfall later this year. That means inflation will be higher, and recession risks are bigger than they otherwise would have been — because consumers spending more on energy will have less cash left for other stuff. Russian President Vladimir Putin, meanwhile, gets a bigger war-chest to fund his attack on Ukraine.

But more significant is what the OPEC+ move says about the likely path of oil prices over the coming years.

In a world of shifting geopolitical alliances, Saudi Arabia is breaking away from Washington’s orbit. The Saudis set oil production levels in coordination with Russia. When they wanted to ease tensions with regional rival Iran, they turned to China to broker a deal — with the US left out of the loop. Western influence over the oil cartel, in other words, is at its lowest point in decades.

And the OPEC+ members all have priorities of their own, from Saudi Crown Prince Mohammed Bin Salman’s ambitious plans to reinvent his economy, to Putin’s war. Any extra revenue they get from charging more for oil is a help.

Asked about US concerns that OPEC+ has twice elected to cut production since President Biden's visit to Saudi Arabia, a State Department spokesperson said the administration is focused on holding down domestic energy prices and ensuring US energy security. The US views production cuts as inadvisable given ongoing market volatility, but will wait to see what actions OPEC+ ultimately takes, said the spokesperson.

Meanwhile, the threat of competition from US shale fields, a deterrent to price hikes in the past, has receded. And while there’s a global effort to reduce fossil-fuel use — and higher prices will accelerate that effort — the dash to drill in the last year shows that the zero-carbon economy remains more long-term aspiration than short-term driver.

Add all of this up, and while some analysts say demand hurdles mean the recent bump in prices could prove fleeting, most anticipate prices above $80 a barrel over the coming years — well above the $58-a-barrel average price between 2015 and 2021.

Crude Shock

It’s been a volatile 18 months or so on crude markets, with three main phases.

-

In the run-up to Russia’s invasion of Ukraine — and even more so in its immediate aftermath — prices soared, hitting around $120 a barrel in June 2022.

-

Then the trend went into reverse. Concerns about a recession in Europe, rapidly rising interest rates in the US and China’s Covid restrictions combined to push the price down to around $75 in December.

-

Demand started to pick up at the beginning of 2023, largely due to reopening in China - the world’s largest importer. Last month’s banking turmoil halted the rally – but it had resumed even before the surprise OPEC+ output cut, which lifted prices to $85 a barrel from $80.

For the global economy writ large, lower oil supply and higher prices is bad news. The major exporters are the big winners, of course. For importers, like most European countries, more expensive energy is a double blow — dragging on growth even as inflation rises.

The US falls somewhere in between. As a major producer, it benefits when prices rise. But those gains — unlike the pain of higher pump prices — aren’t widely shared.

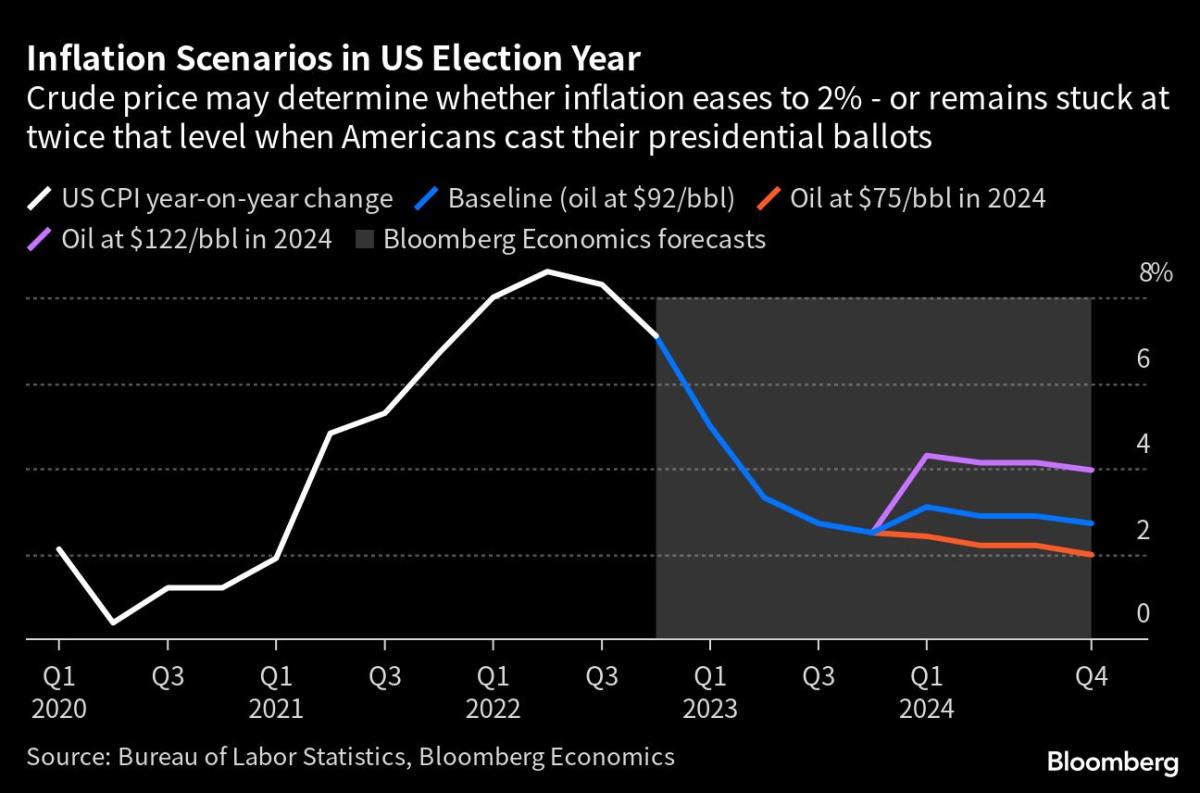

Bloomberg Economics’ SHOK model predicts that for every $5 increase in oil prices, US inflation will rise by 0.2 percentage point — not a dramatic change, but at a time when the Federal Reserve is struggling to bring prices under control, not a welcome one either.

There are three key reasons why more such shocks may be in store: The geopolitical shift, the maturing of shale, and the Saudi spending splurge.

Geopolitical Frictions

For decades, the US-Saudi “oil for security” pact has been a pillar of the energy market. Now it’s wobbling. Symbolized by the 1945 meeting between President Franklin D. Roosevelt and King Abdul Aziz Ibn Saud, aboard a US cruiser in the Suez Canal, the deal gave the US access to Saudi oil in exchange for guaranteeing the kingdom’s security.

But the pact is no longer what it once was:

-

In 2018, Washington Post columnist and Saudi dissident Jamal Khashoggi was assassinated at the Saudi consulate in Istanbul.

-

In 2019, Biden — then a presidential candidate — threatened to turn Saudi Arabia into a pariah state and halt arms sales.

-

In 2021, early in his presidency, Biden released an intelligence report assessing that Crown Prince Mohammed, the kingdom’s de facto ruler, was responsible for the Khashoggi assassination.

-

In October 2022, OPEC+ lowered oil production by 2 million barrels a day — less than three months after Biden flew to Riyadh seeking an increase. The White House blasted the move as “short-sighted.”

-

Last month, Saudi Arabia and Iran agreed to restore diplomatic ties in a deal brokered by China and signed in Beijing.

-

The Saudi government has also agreed to join the Shanghai Cooperation Organization – a group with China and Russia at the helm, and seen as a rival to Western institutions — as a “dialogue member”.

"The Saudis are looking for an aggressive hedge," said Jon Alterman, director of the Middle East Program at the Center for Strategic and International Studies, a Washington-based think tank. "Given what the Saudis see as a radically unpredictable US policy, they think it's irresponsible not to look for a hedge. And by radically unpredictable, you're looking at a US policy that changed sharply between Obama and Trump and Biden."

In the aftermath of the April 2 move, Saudi officials said it was motivated by national priorities rather than any diplomatic agenda.

“OPEC+ has succeeded now and in the past in stabilizing oil markets, and contrary to claims by Western and industrial states this has nothing to do with politics,” former Saudi oil ministry adviser Mohammad Al Sabban said, according to Asharq Al-Awsat newspaper.

Read More: Saudi Arabia Emboldened on World Stage Underpins OPEC Decision

Shale Buffer?

In the past, OPEC+ was often torn: it wanted high prices, but worried that they’d attract more competition, particularly from US shale oil. That disagreement is what drove a price war between Russia and Saudi Arabia in 2020 — which ended when then-US President Donald Trump brokered a deal.But the dilemma barely exists now. Rising US wages and inflation have increased the cost of shale production, leading to slower output growth. And firms are prioritizing the distribution of profits to shareholders rather than investing them into expanding production.

OPEC+ Budget Needs

Oil producers, meanwhile, have their own objectives.

Saudi oil is cheap to extract. And the kingdom only needs prices at $50-$55 a barrel to fund its imports and offset remittance outflows. But it requires a higher price of $75-$80 to balance the budget — and even that doesn’t tell the whole story.

Saudi Arabia has an expensive social contract with its citizens, promising prosperity in return for political acquiescence. To keep its side of the deal, the government needs to invest in its non-oil industries — which employ most Saudis. Petrodollars pay that bill.

Saudi Arabia’s sovereign wealth fund aims to spend $40 billion a year on the domestic economy — including the construction of Neom, a futuristic city in the desert with an estimated price-tag of $500 billion — on top of outside investments. Those figures don’t show up in the budget. To meet all these goals, the kingdom needs an oil price closer to $100.

In Russia, meanwhile, President Putin is counting on oil revenues to fuel his war machine. Bloomberg Economics Russia economist Alex Isakov calculates that a price tag of $100 a barrel is required to balance the Kremlin’s books.

October Surprise?

To be sure, the White House appears unfazed with the latest round of production cuts. This may partly reflect expectations that the actual output decline may be smaller than the headline number of over 1 million barrels per day. Compliance among OPEC+ member with the cuts may also be less than perfect. In February, Russia pledged to unilaterally cut output. In reality, flows only began to fall last week.

Still, the consensus among analysts is for oil prices to average $85-$90 a barrel this year and next. What if OPEC+ decides to come up with another output cut next year, ahead of US presidential elections, undermining Biden’s chances of winning?

Bloomberg’s economic scenario modeling tool — SHOK — suggests that supply cuts pushing oil to about $120 per barrel in 2024 would keep US inflation at nearly 4% by the end of 2024 compared with a baseline forecast of 2.7%. And conventional wisdom says that high pump prices hurt incumbent politicians at the ballot box.

Terminal clients can see a SHOK scenario with oil at $120/barrel here

Of course, a setback to the US economy would increase risks of a wider recession that curbs appetite for oil and undoes the effect of supply cuts. Still, the US share of global GDP is declining, and nations like China and India are major contributors to oil demand. China buys significant volumes of Russian and Iranian oil at a discount — partially shielding it from the price hike.

India, another large and fast-growing emerging economy, is also getting cheap fuel from Russia, which has become its largest supplier. Tellingly, Delhi — which in the past expressed disappointment with OPEC+ cuts — has stayed silent about the latest round.

“For the first time in recent energy history, Washington, London, Paris and Berlin don’t have a single ally inside the OPEC+ group”

Read more from Bloomberg Opinion’s Javier Blas here

It Goes in Cycles

High oil prices tend to sow the seeds of their own demise, encouraging more investment in production by firms seeking to capture bigger profits.

An oil glut in the 1980s followed the boom of the 1970s, as production expanded in Siberia, Alaska, the Gulf of Mexico and the North Sea. The pattern was repeated in the oil boom of the 2000s, which ended with the emergence of US shale and cratering prices in 2014.

There’s more urgency this time around. Environmental targets are pushing countries to reduce dependence on fossil fuel. National security concerns in Europe — which until the war in Ukraine turned off the taps, was heavily reliant on Russian oil and gas — could speed the transition.

And there’s no guarantee that the Saudis, Russia and the rest of the OPEC+ cartel will be able to maintain their united front. That’s easier to do when prices are high — but when the cycle turns, members prove less willing to limit supply.

Still, at least for now, the price of the world’s most important commodity is being set by a country the US can no longer count on as a friend.

(Updated to include new OPEC data in third graf. A previous version corrected a photo caption to clarify that Roosevelt met with King Ibn Saud of Saudi Arabia on Feb. 14, 1945.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

"oil" - Google News

April 13, 2023 at 07:32PM

https://ift.tt/BQVg0eH

US-Saudi Oil Pact Breaking Down as Russia Grabs Upper Hand - Yahoo Finance

"oil" - Google News

https://ift.tt/XIn4p5Z

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "US-Saudi Oil Pact Breaking Down as Russia Grabs Upper Hand - Yahoo Finance"

Post a Comment