The oil price collapse has taken its toll on mergers and acquisitions (M&A) across the U.S. oil and gas industry as companies preserve cash in these highly uncertain times.

The appetite for dealmaking in the second quarter, when WTI Crude prices plunged to a negative $37 a barrel one day in April, was so low that Q2 ranked as the third-lowest quarterly value of upstream deals since 2009, oil & gas data analytics company Enverus said this week.

Compared to the first quarter, the value of oil and gas deals jumped by more than 200 percent in Q2 – to US$2.6 billion from just US$770 million in Q1, Enverus’ U.S. upstream M&A report showed.

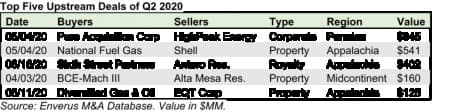

However, the second-quarter deals included Pure Acquisition Corporation’s US$845-million merger with HighPeak Energy in the Permian's Midland basin—a deal that was announced at the end of 2019 and was later recalibrated after the oil price crash. This was the biggest deal in terms of value in Q2.

The other major deals in the top five were for gas assets, predominantly in the Appalachia region, where buyers scooped low-cost assets amid stronger future pricing of natural gas compared to the lows in spot prices seen so far this year.

"While the spot market for natural gas is still suffering from low prices, the future curve 12 or 24 months out is significantly higher. That is permitting buyers to hedge future production at levels that support deal economics," Andrew Dittmar, senior M&A analyst at Enverus, said.

The largest gas deal in Q2 was Shell's sale of its Appalachia shale gas assets for US$541 million to National Fuel Gas Company (NFG).

Deals in the oil industry, however, continue to be scarce and challenged by volatile prices and uncertain demand recovery.

"Broadly, the market for new deals remains highly challenged, particularly in oil plays," Dittmar added. Related: Exxon Is Big Oil’s Outlier In The Post-Pandemic World

In Q1, the deal market collapsed, Enverus said in its M&A report for the first quarter, with all deals taking place before the crash in oil prices in early March, and the largest deals including a bankruptcy sale.

Looking beyond Q2, Enverus sees more gas asset sales, provided that futures prices stay high, with sales potentially extending from Appalachia to other areas of low-cost supply such as the Haynesville.

"However, the market for assets in major oil shale plays, which were the key driver of M&A values for quite a few years, is likely to remain challenged barring a rally in crude prices. Public companies of all sizes are facing significant financial headwinds, making it difficult to convince skeptical investors on the value of M&A," Enverus said.

There could be some great value opportunities for deals in this environment, as consolidation is a necessity, Deloitte said in a recent report on the U.S. shale patch.

"The key question is what to buy and, more importantly, what not to buy. Any large acquisition or merger should be considered only if one plus one is greater than two on both operational and financial fronts," according to Deloitte.

While some companies may be considering acquisitions, others are struggling to survive at these low oil prices, and U.S. oil production has curtailed around 2 million bpd of output since the oil price crash.

The rig count has collapsed in recent months, although the decline has started to slow in the past two weeks, according to Baker Hughes data. The number of oil rigs dropped by 3 rigs for the week to July 2, bringing the total to 185—compared to 788 active rigs this time last year. According to EIA estimates, U.S. oil production held for the second week at 11 million bpd for the week ending June 26. But oil production is still 2.1 million bpd less than the all-time high from the start of this year.

The shale patch slashed expenditures for 2020 and suspended production guidance after the price crash.

"Oil prices have risen significantly since the May lows, and we expect that most E&P companies will issue more definitive production guidance, along with recalibrated drilling and completion activity, in their first half 2020 earnings reports in a few weeks," RBN Energy said in a note last week.

Although some producers are starting to bring back part of the production they had curtailed, it will likely be a few years – or never – until U.S. crude oil output returns to its pre-crisis levels of 13 million bpd.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

Tsvetana Paraskova

Tsvetana is a writer for Oilprice.com with over a decade of experience writing for news outlets such as iNVEZZ and SeeNews.

More Info"oil" - Google News

July 04, 2020 at 05:01AM

https://ift.tt/38xDJTe

High Quality Oil And Gas Assets Should Drive An M&A Recovery - OilPrice.com

"oil" - Google News

https://ift.tt/2PqPpxF

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "High Quality Oil And Gas Assets Should Drive An M&A Recovery - OilPrice.com"

Post a Comment