When the bottom fell out of international crude oil markets earlier this year, global oil storage was at a premium. In the United States, finding sufficient crude oil storage became such a challenge that the West Texas Intermediate crude benchmark plummeted below zero on April 20, ending the day at -$37.63 per barrel, meaning that you would essentially be paid $40 to take a barrel of oil off of someone’s hands. China, however, soon busied itself stocking up on cheap oil, to the extent that Beijing played a key role in the global oil market’s recovery by helping to buy off a significant portion of the world’s severe oil glut. This is not to say that China’s government was alone in taking advantage of historically low oil prices or buying up oil in an attempt to salvage their own struggling energy sector. Back in March, the United States government pledged to support domestic oil producers by buying 30 million barrels of oil for the nation’s Strategic Petroleum Reserve. “But analysts said that China's stockpiling dwarfs what other nations have done in response to cheap prices,” writes CNN. Matt Smith, director of commodity strategy at ClipperData, told CNN’s reporters that "China is the only country that has been buying like crazy. They went out and bought the dip."

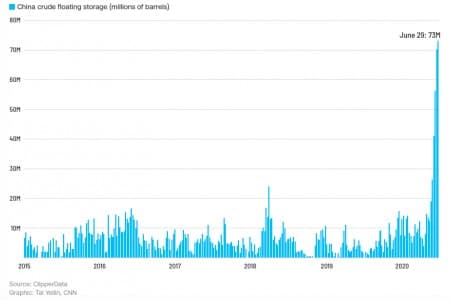

In fact, China went out and snapped up cheap crude at such a breakneck place that they now have their own critical oil storage issue. International news has been reporting for weeks on China’s jam-packed waterways filling up with crude tankers. On July 1 CNN reported that “China bought so much foreign oil at dirt-cheap prices this spring that a massive traffic jam of tankers has formed at sea waiting to offload crude” as the country’s purchases begin to arrive. “China's so-called floating storage -- defined as barrels of oil on vessels waiting for seven days or longer -- has nearly quadrupled since the end of May, according to ClipperData. Not only is that the most on record going back to early 2015, it's up seven-fold from the monthly average during the first quarter of 2020.”

Related: China Inks Military Deal With Iran Under Secretive 25-Year Plan

The vast majority of the oil arriving to China in recent weeks was purchased in April and May, when low prices spurred a shopping spree. “The hoarding of oil at sea is a reflection of China's bargain-hunting during a time of extreme stress in the energy market,” writes CNN. According to the report, the oil tanker issue crowding China’s seas is not, however, because mainland storage is already at capacity, but simply because they can’t get it there fast enough. ClipperData’s Smith said that onshore storage could still take on a lot more crude, and that the current issue is “simply related to terminal congestion. They've got so much coming in that they can't bring it onshore quickly enough."

This week, however, at least one Chinese news outlet is telling a different story. While China’s onshore storage may not be full, they say, it’s getting dangerously close. Just this week, Beijing-based media group Caixin reported that “China is almost out of space to hold the oil that domestic traders bought at bargain-basement prices earlier this year when the Covid-19 pandemic crushed global crude demand.”

Caixin’s reporting is based on numbers provided by Oilchem China, which show that, as of Wednesday, Chinese crude oil storage was at 69 percent capacity “with the 33.4 million tons it had stockpiled, up by 24% from the previous year.” This is dangerously close to overflow. “That’s only 1 percentage point away from the 70% threshold that experts view as the country’s capacity limit,” reports Caixin.

And this stockpile will likely continue to grow, surpassing even May’s massive intake. “The situation, which has also been exacerbated by low turnover, is most prominent in East China’s Shandong province, one of the country’s oil refining hubs. Oil tankers have to wait 15 to 20 days there before they are able to offload their cargos,” says Caixin. The amount of oil held in storage may peak later this month as the country’s demand for fuel continues its slow march to recovery, but if not, this could spell big trouble for China’s storage sector.

By Haley Zaremba for Oilprice.com

More Top Reads From Oilprice.com:

Haley Zaremba

Haley Zaremba is a writer and journalist based in Mexico City. She has extensive experience writing and editing environmental features, travel pieces, local news in the…

More Info"oil" - Google News

July 08, 2020 at 07:03AM

https://ift.tt/3iDln7P

World's Biggest Oil Importer Is Running Out Of Storage - OilPrice.com

"oil" - Google News

https://ift.tt/2PqPpxF

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "World's Biggest Oil Importer Is Running Out Of Storage - OilPrice.com"

Post a Comment