Oils Breathtaking Advance

Thus far in 2023, crude oil futures are trading in a choppy frustrating range. That said, perspective is essential. From April 2020 to March 2022, oil prices went on one of its most breathtaking advances ever, from $6.50 to $130 a barrel. The hike in oil prices over the past few years can be attributed to several different factors, including:

· Supply & Demand Imbalances:Production cuts from OPEC and a recovering Asia Pacific economy has caused the imbalances seen today.

· Geopolitical Turmoil: The War in Ukraine and tensions between the United States and Iran are playing a factor in keeping inflating oil prices.

· Environmental Policy: A push by global governments to reduce carbon emissions is increasing the cost of production and consumption, leading to higher prices.

Have Oil Stocks Come Too Far?

The ranges in crude oil prices and oil-related stocks have shrunk dramatically over the past few months. Often, a contraction in prices leads to expansion. With that in mind, the current tug-of -war between bulls and bears will likely be resolved soon. Below are 3 reasons oil stocks are set to move higher in 2023:

1. Valuations are Reasonable: While oil prices have gone on a dramatic run over the past few years, valuations remain attractive relatively speaking. Oil giants such as Halliburton HAL, Chevron CVX, and Exxon Mobil XOM are trading at PE ratios well below that of the S&P 500 Index. For example, Exxon trades at ~8x earnings while the S&P 500 Index trades at 18x.

Image Source: Zacks Investment Research

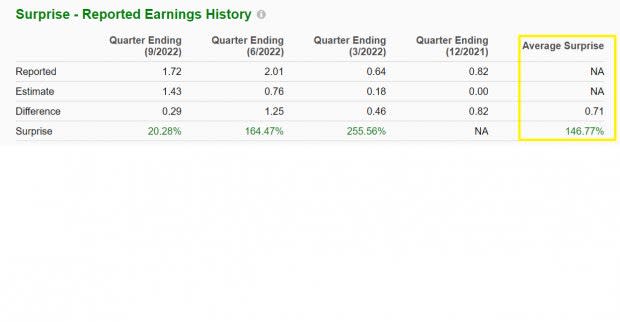

2. Earnings Surprise History: Though higher crude oil prices have meant higher earnings expectations, many oil companies are still jumping over the expectation hurdle. For example, Argentine oil producer YPF Sociedad Anonima YPF has crushed earnings on average by an eye-popping 146.77%!

Image Source: Zacks Investment Research

3. Institutional Conviction: On Monday, a recent SEC filing divulged that Warren Buffett’s Berkshire Hathaway (BRKA) snapped up 5.8 million more shares of Occidental Petroleum OXY. Berkshire’s total number of shares owned is around 200 million, equating to ownership of roughly 22% of the company.

Bottom Line

While oil has digested its gains thus far in 2023, several factors suggest that the run in oil stocks may not be over. First, environmental policy, geopolitical turmoil, and supply and demand imbalances are likely to remain stagnant for the foreseeable future. Secondly, strong growth, coupled with reasonable valuations and institutional backing should lead to higher prices for the remainder of 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Halliburton Company (HAL) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

YPF Sociedad Anonima (YPF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

"oil" - Google News

March 08, 2023 at 09:42PM

https://ift.tt/FNJk5xr

Can Oil Stocks Continue to Trend Higher? (Buffett Buys More) - Yahoo Finance

"oil" - Google News

https://ift.tt/OQNBgjk

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Can Oil Stocks Continue to Trend Higher? (Buffett Buys More) - Yahoo Finance"

Post a Comment