(Bloomberg) -- Oil extended a weekly gain as investors braced for further volatility amid the fallout from the banking crisis rippling across markets.

Most Read from Bloomberg

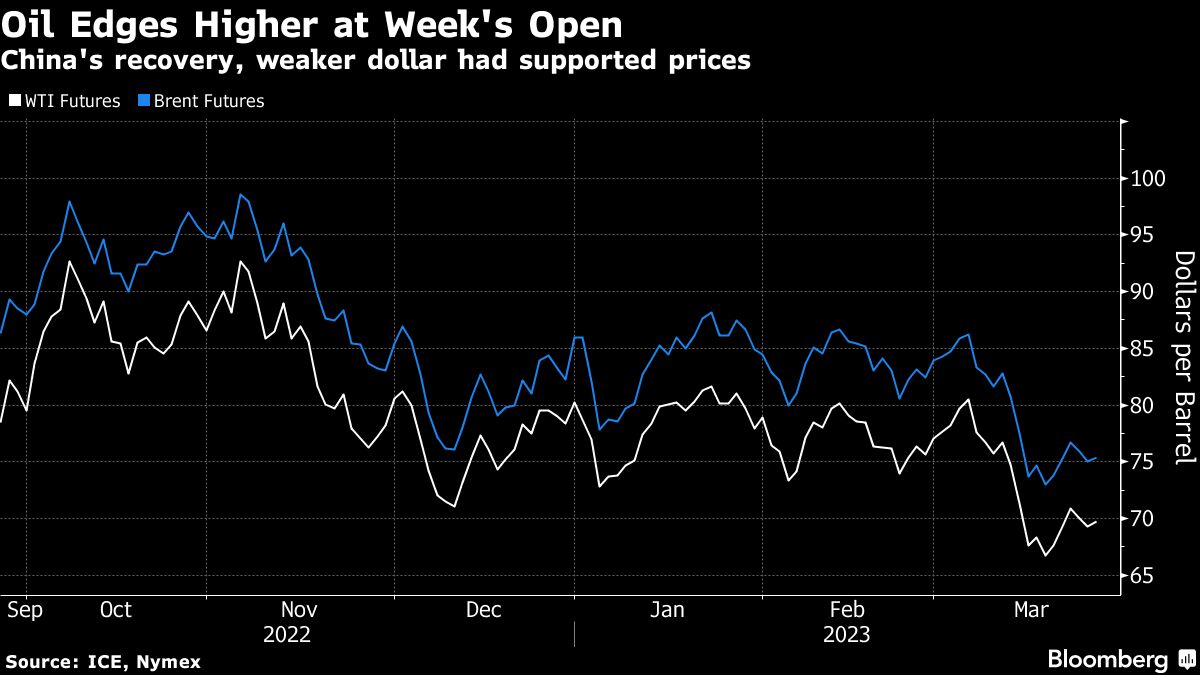

West Texas Intermediate advanced toward $70 a barrel after closing almost 4% higher last week, aided by a weaker dollar. Investors are counting on China’s rebound from Covid curbs to accelerate later this year and boost prices, but concerns over banking and US monetary policy may drag on near-term demand.

See also: Oil Traders’ Bearish Turn Defies Their Own Predictions for Gains

Crude remains on track for its steepest first-quarter loss since 2020, when the pandemic pummeled energy demand. A potential US recession, strikes at French refineries and resilient Russian output have weighed on futures, with JPMorgan Chase & Co. forecasting Brent could break $60 a barrel in the near term.

In France, Exxon Mobil Corp. said it would begin shutting down its Gravenchon refinery — representing 20% of the country’s refinery capacity — on Saturday because of a lack of crude supply due to ongoing protests. That’s hit producers like Nigeria, with half of the nation’s April oil shipments still left unsold.

Energy Daily, Bloomberg’s daily energy and commodities newsletter, is now available. Sign up here.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

"oil" - Google News

March 27, 2023 at 06:00AM

https://ift.tt/VD9OAwE

Oil Edges Higher After Weekly Gain as Banking Concerns Linger - Yahoo Finance

"oil" - Google News

https://ift.tt/qvhO9zV

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Oil Edges Higher After Weekly Gain as Banking Concerns Linger - Yahoo Finance"

Post a Comment