(Bloomberg Opinion) -- At the point we’re now at, postponing the oil-price war won’t make a lot of difference for an industry that’s already breaking down under the weight of demand destruction. It’s too late to use diplomacy and artful negotiations to share the burden of output cuts that are now inevitable.

The pumping free-for-all unleashed by Saudi Arabia and Russia is important for the long-term shape of the oil industry, but, as my colleague Javier Blas pointed out here, it’s a sideshow to the havoc being wrought by the lockdowns crippling economies worldwide in response to the coronavirus pandemic. Forecasts of a catastrophic drop in oil demand abound, with estimates of a whopping 20% year-on-year reduction in global consumption in April becoming more common. That’s 20 million barrels a day, equivalent to the entire consumption of the United States.

It would be impossible for any small group of producers to mitigate that kind of impact by reducing output, unless Saudi Arabia and Russia were both to slash their production to almost zero. And that’s not going to happen.

On Wednesday, U.S. Secretary of State Mike Pompeo called on Saudi Arabia’s Crown Prince Mohammed bin Salman to take the lead as his country prepared to host a meeting of the Group of 20 nations. Pompeo urged the kingdom “to rise to the occasion and reassure global energy and financial markets.” That’s a reasonable request. Somebody has to show leadership and it doesn’t look like it’s going to be President Donald Trump.

The trouble is that I suspect what Pompeo meant is for Saudi Arabia to cut its production unilaterally, rather than trying to bring together a short-term “coalition of the willing,” including the U.S., to work together to confront a global problem. After all, that’s always what’s happened in the past.

Take for example the response to the Asian financial crisis. In February 1999, then President Bill Clinton’s energy secretary, Bill Richardson, expressed U.S. concerns over oil prices that had fallen below $10 a barrel. Two months later the Organization of Petroleum Exporting Countries agreed to its third successive output cut and by the end of the year Brent crude had recovered to $25 a barrel.

It’s no surprise that Saudi Arabia was willing to take the lead back then, and to bear the bulk of the output cuts. It, too, wanted higher oil prices. Those were the days when oil was regarded as a depleting asset whose value would only rise in the future, as demand outstripped available supply. Cutting production would leave oil in the ground that would appreciate in value.

But that was a long time ago. That view no longer holds sway — battered both by the tsunami of crude extracted from shale rocks and the growing awareness of the need to reduce carbon dioxide emissions that has seen concerns about peak oil production replaced with worries (for producers) of peak oil demand. Oil left in the ground now is at risk of never being produced at all.

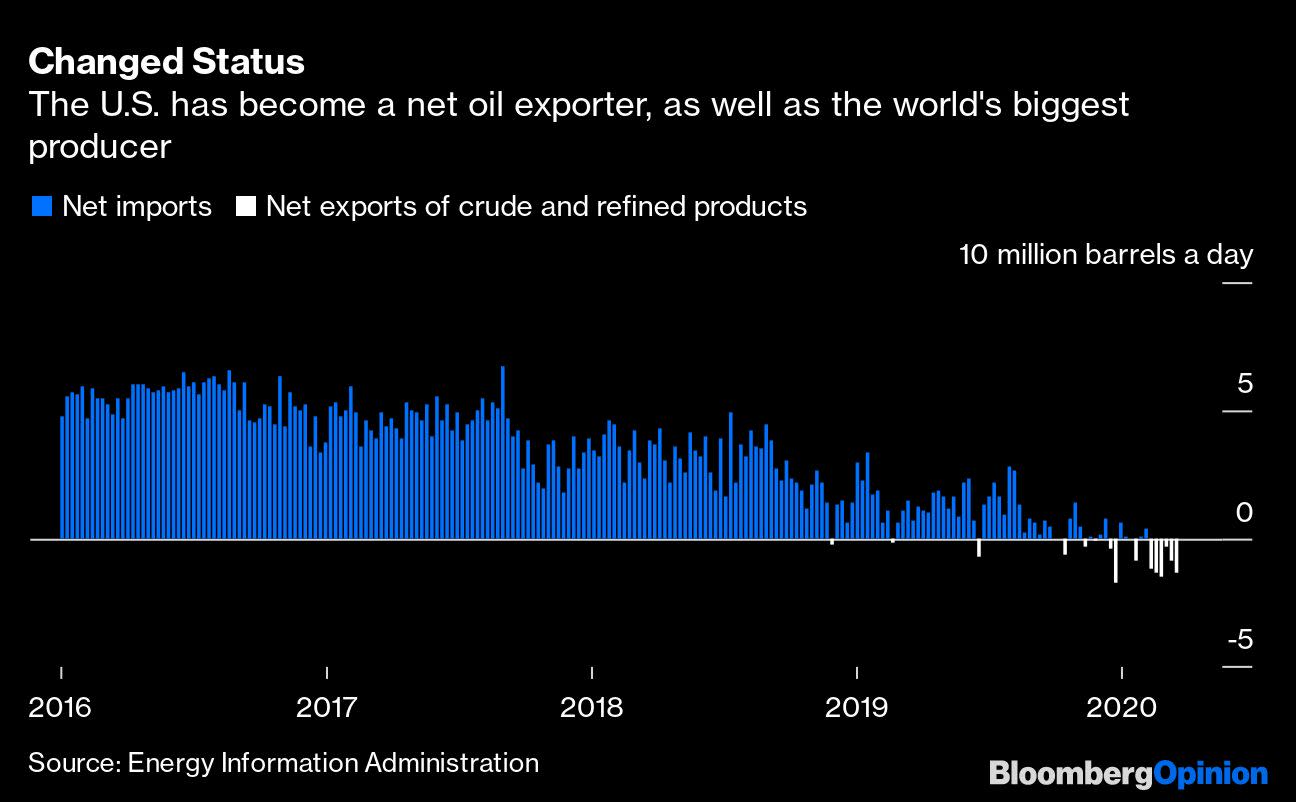

Of course back in 1999, it would have been unreasonable to expect America to join in the output reduction effort. The U.S. was pumping a little over 6 million barrels a day — less than half its current production — and the gas-guzzling nation imported about 10 million barrels a day more crude and refined products than it exported.

But 2020 is not 1999. The U.S. is now the world’s biggest crude producer, pumping 13 million barrels a day — more even than Saudi Arabia can supply if it opens its taps fully. And so far this year it has exported more oil than it has imported.

Yet a lack of leadership — from Riyadh and Washington — means that it’s now too late to make a coordinated response to the collapse in demand.

As it stands at the moment, OPEC is not due to meet until early June, and whether the cartel’s external allies including Russia join them in an enlarged OPEC+ shindig remains to be seen. No matter, any action agreed then wouldn’t have an impact until July, at the earliest. Even an agreement reached tomorrow would have little impact until May, with April crude sales now largely completed.

By then storage tanks around the globe will be close to capacity; ships full of unwanted oil will be floating in safe anchorages; and producers will be forced to shut wells because they have simply run out places to put any crude they pump out of the ground.

Without output cuts, production shut-ins are inevitable. Consultants IHS Markit see a surplus of 1.8 billion barrels of crude building up during the first half of 2020, and yet there’s only 1.6 billion barrels of storage capacity available.

The window to distribute those cuts in an orderly manner between producers has closed. OPEC had its last chance in March and America’s leaders subsequently squandered their chance at leadership. As it now stands, production cuts will be distributed by the market on the basis of who has access to storage tanks and who is losing money by pumping. Welcome to the free market.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Julian Lee is an oil strategist for Bloomberg. Previously he worked as a senior analyst at the Centre for Global Energy Studies.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

"oil" - Google News

March 29, 2020 at 01:06PM

https://ift.tt/3asxkJ4

Welcome to a Truly Free Oil Market - Yahoo Finance

"oil" - Google News

https://ift.tt/2PqPpxF

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Welcome to a Truly Free Oil Market - Yahoo Finance"

Post a Comment